Today, I want to share how our innovative multilevel corporate card system can radically change expense management in your company. My name is Emil Kerimov, I am the founder of the Ektico project, and I am confident that our system will help you achieve amazing results.

Have you ever encountered situations where company expenses spiral out of control, approval processes drag on endlessly, and fraud risks increase with each passing day? Our solution is your answer! With our system, you can set strict spending limits, instantly block and reissue cards, and control expense categories. Imagine how much faster and more efficient your financial operations will become!

Challenges in Managing Corporate Expenses

Modern companies often face various challenges in managing corporate expenses, including:

- Lack of Control and Transparency: Without a clear control system, companies find it difficult to track expenses and ensure they comply with established policies.

- Slow Approval and Reimbursement Processes: Manual approval and reimbursement processes can be slow and error-prone, reducing employee productivity and causing dissatisfaction.

- Fraud Risks: Unauthorized transactions and duplicate expenses can lead to significant financial losses.

- Limited Monitoring Capabilities: Without modern tools, it is difficult to monitor and analyze expenses in real time, which hampers informed decision-making.

Our Solution: A Multilevel Card System

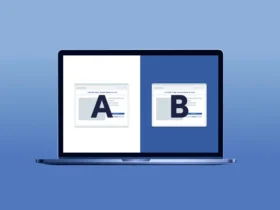

Our solution offers a multilevel card system that allows managing corporate expenses at different levels—from managers to individual employees. Here’s how it works:

- Setting Limits at Different Levels: Key users can set overall limits, which are then distributed among departments and individual employees. For example, in a construction company, each manager can manage the limits of their subordinates, ensuring strict control over expenses for materials and contractor payments. In an educational organization, limits can be set for various departments and faculties to control expenses on educational materials and equipment.

- Card Locking and Reissuing: If necessary, a manager can instantly block a dishonest employee’s card and reissue it in digital form to a new user. This accelerates the replacement process and minimizes loss risks.

- Controlling Expense Categories: Our cards allow blocking certain categories of goods and services, preventing unauthorized expenditures. For example, you can block purchases in categories unrelated to work tasks.

- Verification and Monitoring: Anti-Money Laundering (AML) verification tools allow for instant new user checks, significantly speeding up financial processes and enhancing security levels.

Usage Example

Consider a transportation company with 50 drivers. Suddenly, one of them turns out to be a dishonest employee. The manager can quickly block his card and reissue it for a new driver. Moreover, the system allows setting spending limits, blocking certain categories of goods and services, and conducting AML checks, which greatly simplifies financial management and enhances transparency.

Advantages of Using Our System

- Process Acceleration: Quick card blocking and reissuing reduce downtime and enhance operational efficiency.

- Improved Control and Transparency: The ability to set limits and monitor expenses in real time ensures a high level of financial discipline.

- Reduced Fraud Risks: Automation of checks and the ability to block expense categories minimize the risks of unauthorized transactions.

- Optimized Management: Centralized management of cards and expenses allows better budget control and more efficient resource utilization.

Conclusion

Ektico’s multilevel corporate card system provides a powerful tool for optimizing corporate expense management. This solution is suitable for companies of any size and from various industries, aiming for transparency and efficiency in financial operations. If you are ready to optimize your expense management, contact us today to learn more about our solutions and start implementing them in your company.

Leave a Reply