Ever fancied owning a slice of that proper Cheshire life, with canal-side walks and a cracking Sunday roast waiting at home? In Warrington, the dream is feeling more reachable than ever. House prices here have climbed a solid 4.5% since early 2023, outpacing the UK average, thanks to some welcome stability in mortgage rates. But what’s really got locals chatting is how savvy brokers are making the whole process less of a headache.

Imagine queuing at the M62 slip road, dreaming of ditching the rental grind for your own place near Walton Hall Gardens. First-time buyers in Warrington are snapping up deals left and right, often with just a 10% deposit these days. Gone are the days when 95% mortgages vanished post-pandemic; they’re creeping back, making that deposit a bit less daunting. Local experts know the ins and outs, like which lenders shy away from flats above shops or council blocks, steering you clear of dead ends.

And it’s not just newbies; families upsizing or downsizing are finding tailored options that fit like a glove. Whether you’re eyeing a fixed-rate for peace of mind or something variable to play the market, advisers cut through the jargon. They start with a quick affordability check, whip up an Agreement in Principle in minutes, and handle the estate agents and solicitors so you can focus on paint colours and flat-screen spots.

Remortgaging: Don’t Let That Renewal Letter Ruin Your Day

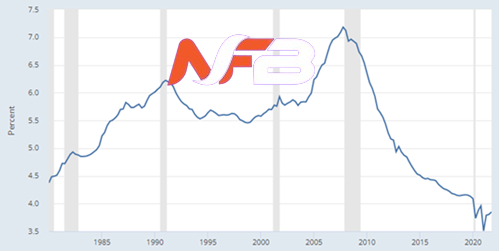

That dreaded mortgage renewal letter lands on the doormat, rates staring back at you like a bad pint. But in Warrington, remortgaging doesn’t have to feel like wading through treacle. With fixed rates dipping below 4.5% from many lenders, now is the moment to switch and pocket some savings. Maybe you’re consolidating debts after Christmas splurges or funding a kitchen revamp, proper granite worktops and all.

For these mortages Warrington brokers get it. They reassess your situation, match you to the best deal, and chase the paperwork so you hit deadlines without sweat. One buyer from Latchford reported that he shaved hundreds off his monthly outgoings just by chatting to a local pro. It’s that simple human touch, no corporate nonsense, that keeps things moving. And if rates keep sliding, as economists reckon with Bank of England cuts on the horizon, locking in early could be a belter.

Buy-to-Let Boom: Warrington’s Rental Scene Heating Up

Warrington’s not just for homeowners; landlords are having a field day too. With tenants queuing for those semi-detached beauties near the town centre, buy-to-let mortgages are gold dust. Not all are FCA-regulated, mind, so you need someone who knows the specialist products inside out. From crunching numbers on yields to securing a Mortgage in Principle, the pros handle the lot, letting you grow your portfolio without the aggro.

It’s the same story for existing landlords remortgaging multiple properties. They’ll tweak finances to maximise returns, whether adding to the empire or weathering market dips. It’s all about that local knowledge, spotting deals others miss. And for those dipping toes in, Help-to-Buy still lingers in spirit, though schemes evolve, helping stretch smaller deposits on new builds or older homes alike.

Lifetime Options and Beyond for Later Life

Lifetime mortgages are picking up pace in Warrington, perfect for releasing equity without monthly repayments. Fancy home improvements, topping up retirement cash, or gifting kids a leg-up on their first pad? Dedicated advisers tailor recommendations, loop in family if needed, and manage applications end-to-end. It’s reassuring stuff when the nest is emptying and you’re eyeing cruises down the Mersey.

Across the board, the vibe in Warrington’s mortgage world is one of genuine support. No pushy sales, just straight talk on affordability, deals, and next steps. First-timers get the full rundown, from pre-qual to keys in hand. Movers dodge the heavy lifting, landlords crunch less spreadsheets.

House prices might keep nudging up through 2026, with UK forecasts eyeing modest gains amid falling rates. But here’s the kicker: waiting could cost you. Chat to a broker today, grab that free consultation, and turn ‘what if’ into ‘keys in pocket’. Warrington’s market is alive, accessible, and ready for you. Whether it’s your first step on the ladder or a portfolio tweak, the right advice makes all the difference.

Leave a Reply